Bitcoin slipped toward $92,000 on Tuesday after a tariff dispute tied to Greenland shook global markets, though some analysts still see room for a rebound toward $99,000 once sentiment steadies.

Bitcoin fell about -2.8% is trading on January 20. It moved near $92,759 after touching an intraday low of $92,245. The drop came as traders pulled back from risk assets across the board.

The move followed fresh jitters over a possible US-Europe trade fight linked to Greenland.

DISCOVER: 9+ Best Memecoin to Buy in 2026

How Did Bitcoin React to the New US–Europe Tariff Risk?

As per a Reuters report, US President Donald Trump threatened new tariffs on several European countries unless Washington is allowed to buy the territory, a stance that rattled investors.

The risk-off tone hit currencies, equities, and crypto at the same time. Reuters called Bitcoin “a liquid proxy for risk,” noting its nearly 3% slide as money shifted into safer assets like the yen and Swiss franc.

European markets also sold off on Monday. Gold climbed to new highs, and silver jumped as traders braced for the possibility of retaliation from Europe.

The tariff threat is unusually clear. Reuters reported that Trump said the US would add a 10% tariff starting Feb. 1.

That rate would rise to 25% by June 1 if no deal is reached over Greenland.

The International Monetary Fund warned the move could set off a “spiral of escalation.” The Guardian reported the IMF said this could spill into broader financial market stress.

CoinGlass data showed Bitcoin’s spot trading volume stood near $6.58Bn, while futures volume reached about $62.4Bn.

The data also showed roughly $235.7M in Bitcoin futures liquidations over the same period, with open interest around $61.28Bn.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

Bitcoin Price Prediction: Is BTC Forming a Base After Its 2025 Correction From $120K?

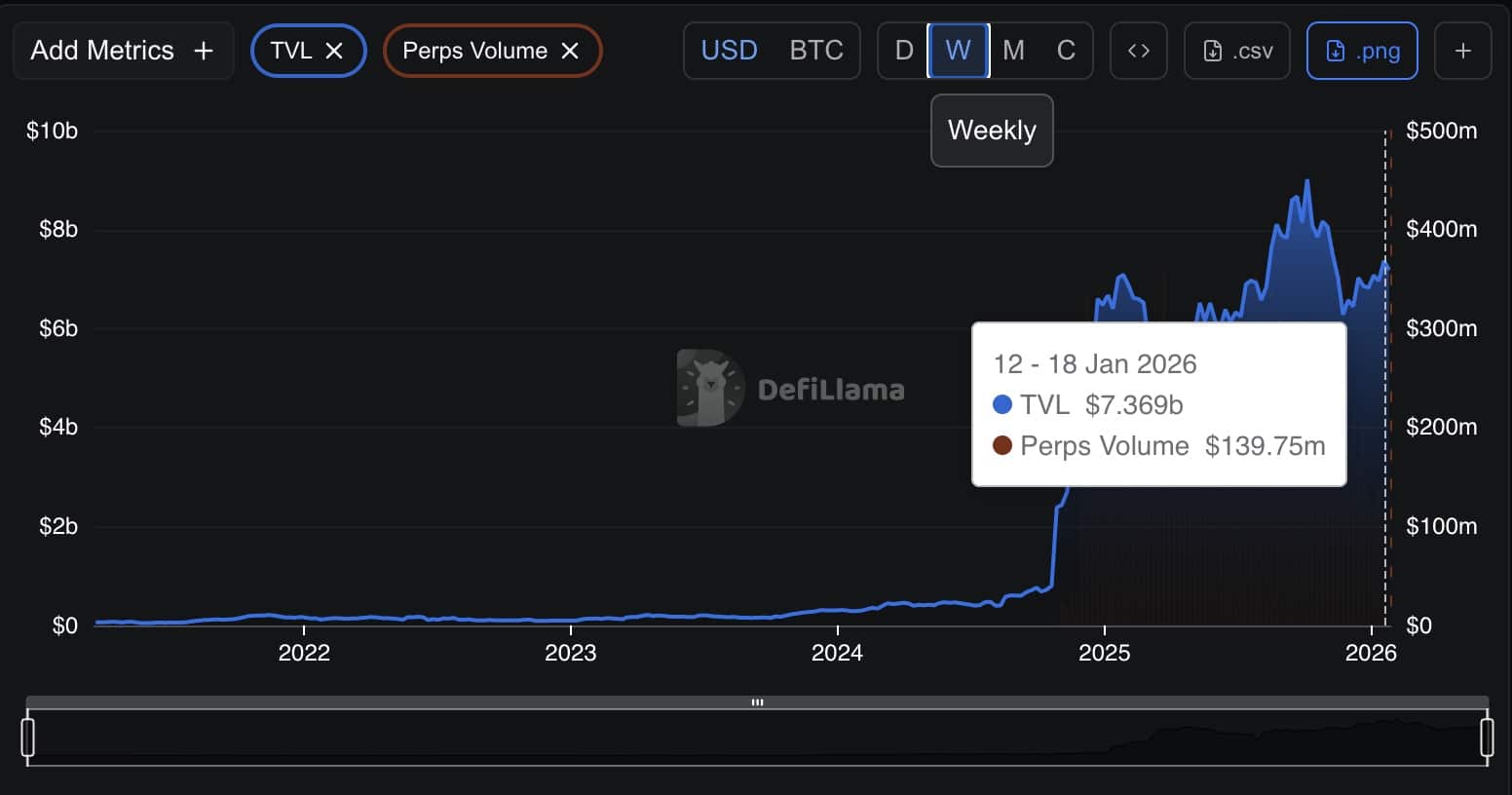

DeFiLlama’s perpetuals dashboard showed elevated on-chain derivatives activity despite the risk-off tone. Perp volume reached about $139.87M over the past week.

Bitcoin, meanwhile, appears to be stabilizing after a sharp correction, with broader liquidity trends helping explain the recent price action.

On the daily chart, BTC/USD peaked above $120,000 earlier in 2025 before entering a clear downtrend marked by lower highs and lower lows.

US liquidity YoY growth bottomed in November 2025.

This also marked the $BTC local bottom.

Now US liquidity is improving, which is one of the reasons I'm expecting a crypto rally.

It's that simple. pic.twitter.com/bD61ImJt7X

— Ted (@TedPillows) January 19, 2026

Selling pressure intensified in November, when prices briefly slipped into the low-$80,000 range.

Bitcoin has built a base and moved into consolidation. Higher lows have formed around the $85,000 to $88,000 area, while resistance has capped moves near $95,000 to $97,000.

This setup suggests selling pressure has eased, even as upside momentum remains restrained.

The lower panel points to a key macro signal: US liquidity growth on a year-over-year basis. Data from Capriole shows liquidity bottomed in November 2025, around the same time Bitcoin hit a local low.

Since then, liquidity has started to improve and is now less negative heading into early 2026. If this trend holds, the chart suggests Bitcoin may be forming the base for a wider trend shift, not just a brief relief bounce.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Key Takeaways

-

Bitcoin slipped toward $92,000 on Tuesday after a tariff dispute tied to Greenland shook global markets, though some analysts still see room for a rebound toward $99,000 once sentiment steadies.

- Bitcoin has built a base and moved into consolidation. Higher lows have formed around the $85,000 to $88,000 area, while resistance has capped moves near $95,000 to $97,000.

The post Gold Hits ATH on Greenland Tensions, But Bitcoin Slides to $90k appeared first on 99Bitcoins.