Understandably, you have to be “strong-willed” to buy Ethereum, XRP, or any top-10 altcoin. The past few weeks has been brutal for promising tokens. And this is expected to continue as long as Bitcoin struggles for momentum.

To put in numbers, Ethereum is down from December 2025 highs of near $3,500. Meanwhile, like Solana, Cardano, and other best cryptos to buy, XRP crypto, despite the XRP Army calling for a moonshot, slid below $2 and is yet to reverse losses.

Still, given this state of crypto market affairs, on-chain data points to a different story. Yesterday, Santiment, an on-chain intelligence platform, said XRP and Ethereum are sitting in an “undervalued” zone based on market value to realized value (MVRV) ratio.

The lower a coin's 30-day MVRV is, the less risk there is in opening or adding on to your position.

A coin having a negative percentage means average traders you're competing with are down money, and there is an opportunity to enter while profits are below the normal… pic.twitter.com/YH8y4IzkWc

— Santiment (@santimentfeed) January 26, 2026

DISCOVER: Best Meme Coin ICOs to Invest in 2026

XRP Crypto and Ethereum Holders In “Pain”

For beginners, the MVRV ratio gauges the “health” of the asset in question. In this case, it is all about XRP and ETH crypto prices. What it does is simple: It compares the current market price, that is, what it’s selling for now, to the average price everyone paid to get their coins.

When the ratio is high, it means holders are in profit, and the opposite is true. Overall, analysts use this metric to determine if a market is overheated (overvalued) or if everyone is in “maximum pain” (undervalued).

The 30-day MVRV by Santiment looks only at people who bought in the last month. When that number turns negative, it means recent buyers are down money on average. Santiment treats this zone as “undervalued” because sellers feel pressure and fewer people rush to take profits.

Given this finding, it appears that ETH and XRP crypto prices are currently trading below the average entry price, and holders are under pressure and in the red. When Santiment shared their findings, the Ethereum 20-day MVRV stood at nearly -8%, while XRP crypto was at -6%.

Interestingly, the same metric for Bitcoin was slightly positive. This shows that despite all eyes tracking Bitcoin, buyers who scooped the digital gold within the last 30 days are at or above break-even. Meanwhile, those who bought ETH or XRP crypto at that time are feeling the pain and might sell and capitulate, heaping more pressure on the price.

DISCOVER: 9+ Best Memecoin to Buy in 2026

Relief Incoming for XRP USD and Ethereum Crypto?

The good news is that the 30-day MVRV for Bitcoin is positive. If it were in negative territory, any sell-off would risk dragging the whole market with it. When this happens, as recent price action shows, not only will ETH USD and XRP crypto dump, but the impact spreads, influencing sentiment, and leading to redemptions across spot XRP and Ethereum ETFs.

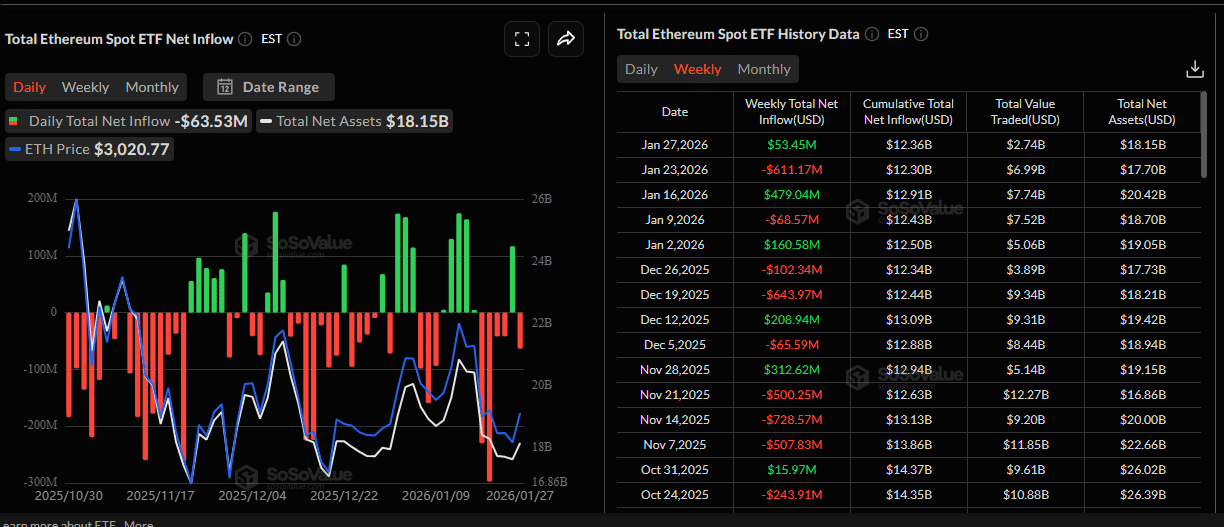

Ethereum crypto prices fell in the last few weeks following massive spot ETF outflows. Trackers show that over $611M of spot Ethereum ETF shares were redeemed, weighing negatively on price.

(Source: SosoValue)

Besides ETFs, whether the upcoming Glamsterdam upgrade in H1 2026 would attract institutional investment in Ethereum. By the end of the year, developers will also implement the Hegota upgrade. Both of these updates will make the network lighter, more performant, and reliable, with the ability of institutions to run nodes safely.

While ETH USD posted losses, the sell-off in XRP crypto has been sharper. Specifically, the drop below $3 and later $2 was mostly due to macro nerves. Threats of more tariffs to eight European countries, coupled with a weaker Bitcoin, accelerated the dump.

However, there is confidence that XRP crypto could turn the corner. With the legal battle fully settled, the “regulatory risk” that suppressed XRP for years is gone. This clarity has reopened doors for US-based banks and regulated funds to use XRP for cross-border settlements without legal fear.

The integration of the RLUSD into the XRP Ledger is the much-needed “bridge” for TradFi. While RLUSD provides stability, XRP remains the “gas” and utility token that powers these high-speed transactions.

Ripple's Brad Garlinghouse answers how prime brokers can bring institutions into DeFi.$XRP $RLUSD pic.twitter.com/SicNaiywl3

— ALLINCRYPTO (@RealAllinCrypto) January 28, 2026

The more RLUSD finds adoption among institutions, the more gas is needed for transaction confirmation. So far, RLUSD is among the largest stablecoins, commanding a market cap of $1.4Bn.

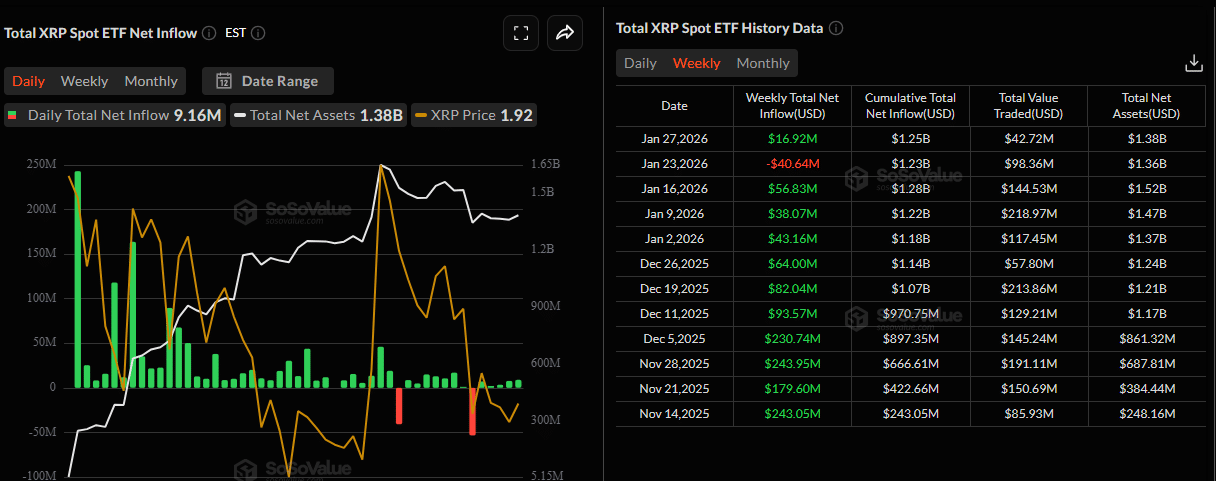

Institutions are also flocking to XRP. Data shows steady inflows to spot XRP ETFs since November 2025 till last wee,k indicating that the big boys could be “accumulating” XRP as a structural asset.

(Source: SosoValue)

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Santiment Flags XRP and Ethereum as Undervalued After Pullback appeared first on 99Bitcoins.