Rich Dad Poor Dad author Robert Kiyosaki says he’s buying more gold, silver, Bitcoin, and Ethereum as he prepares for what he believes could be a sharp economic downturn.

In a post on X on Sunday, Kiyosaki warned that markets may be heading toward trouble. He said he’s shifting more of his money into what he calls “real money,” suggesting he sees these assets as safer than cash.

CRASH COMING: Why I am buying not selling.

My target price for Gold is $27k. I got this price from friend Jim Rickards….and I own two goldmines.

I began buying gold in 1971….the year Nixon took gold from the US Dollar.

Nixon violated Greshams Law, which states “When fake…

— Robert Kiyosaki (@theRealKiyosaki) November 9, 2025

Kiyosaki said his view on gold is influenced by economist Jim Rickards.

He also repeated his long-held call that Bitcoin could reach $250,000, arguing that BTC acts as protection against what he describes as the Federal Reserve’s “fake money.”

He pointed to growing interest in Ethereum, citing analyst Tom Lee from Fundstrat, and said he views ETH as the main network supporting stablecoins a role he believes gives it weight in global finance.

Kiyosaki said his views are shaped by two key ideas: Gresham’s Law, which holds that weaker money replaces stronger money in daily use, and Metcalfe’s Law, which links a network’s value to the size of its user base.

Kiyosaki, who says he owns gold and silver mines, also criticized the US Treasury and Federal Reserve for printing “fake money” to cover rising government debt.

He called the United States “the biggest debtor nation in history” and repeated his long-running claim that “savers are losers,” urging people to hold hard assets even when markets are under pressure.

At the same time, some on-chain signals indicate a more favorable outlook for Bitcoin.

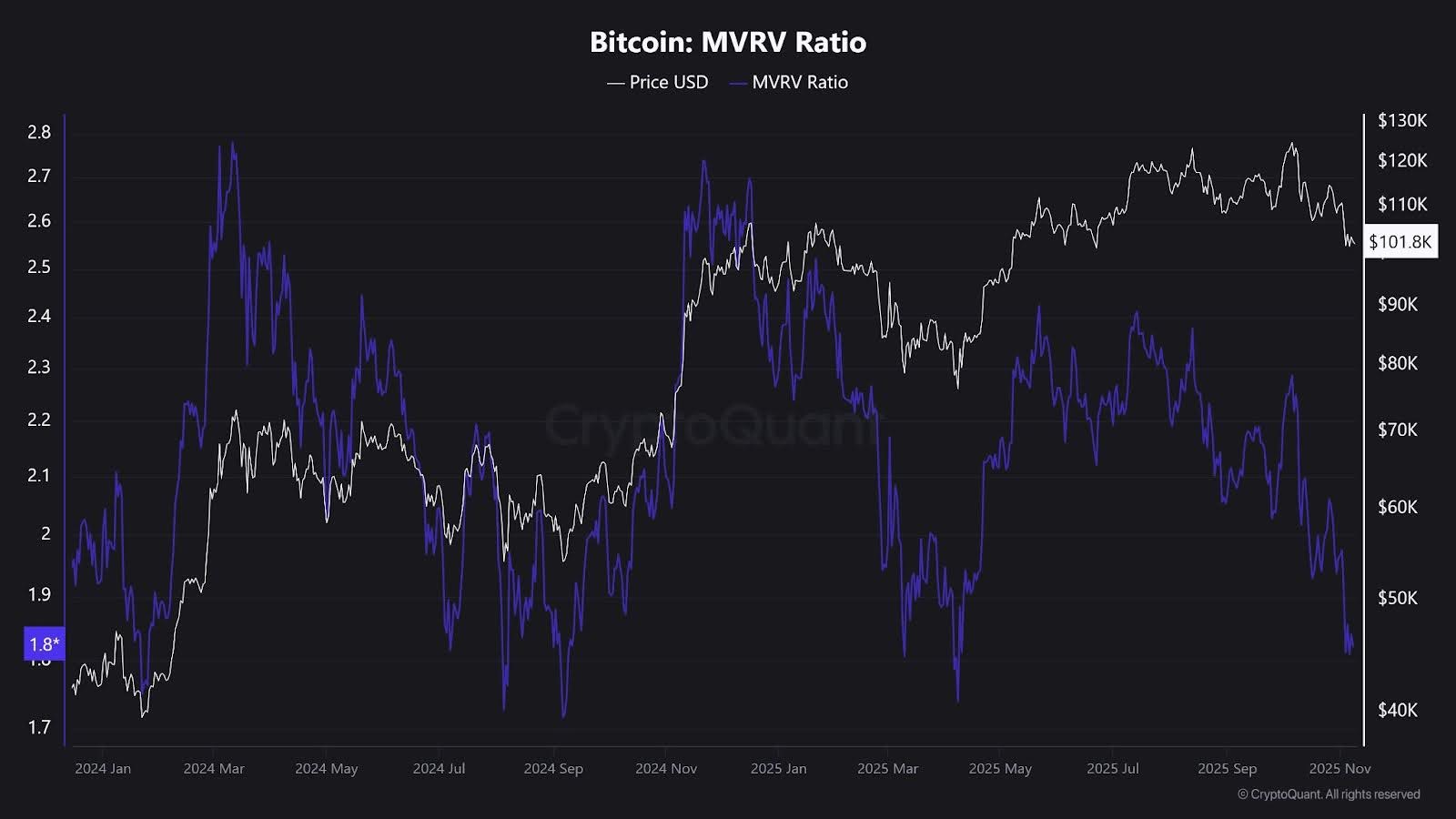

Market analyst Crypto Crib noted that BTC’s Market Value to Realized Value (MVRV) ratio has risen to about 1.8. In past cycles, similar readings came before rebounds of roughly 30%–50%.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Bitcoin Price Prediction: What Does BTC Trading Near $102K Signal About Market Sentiment?

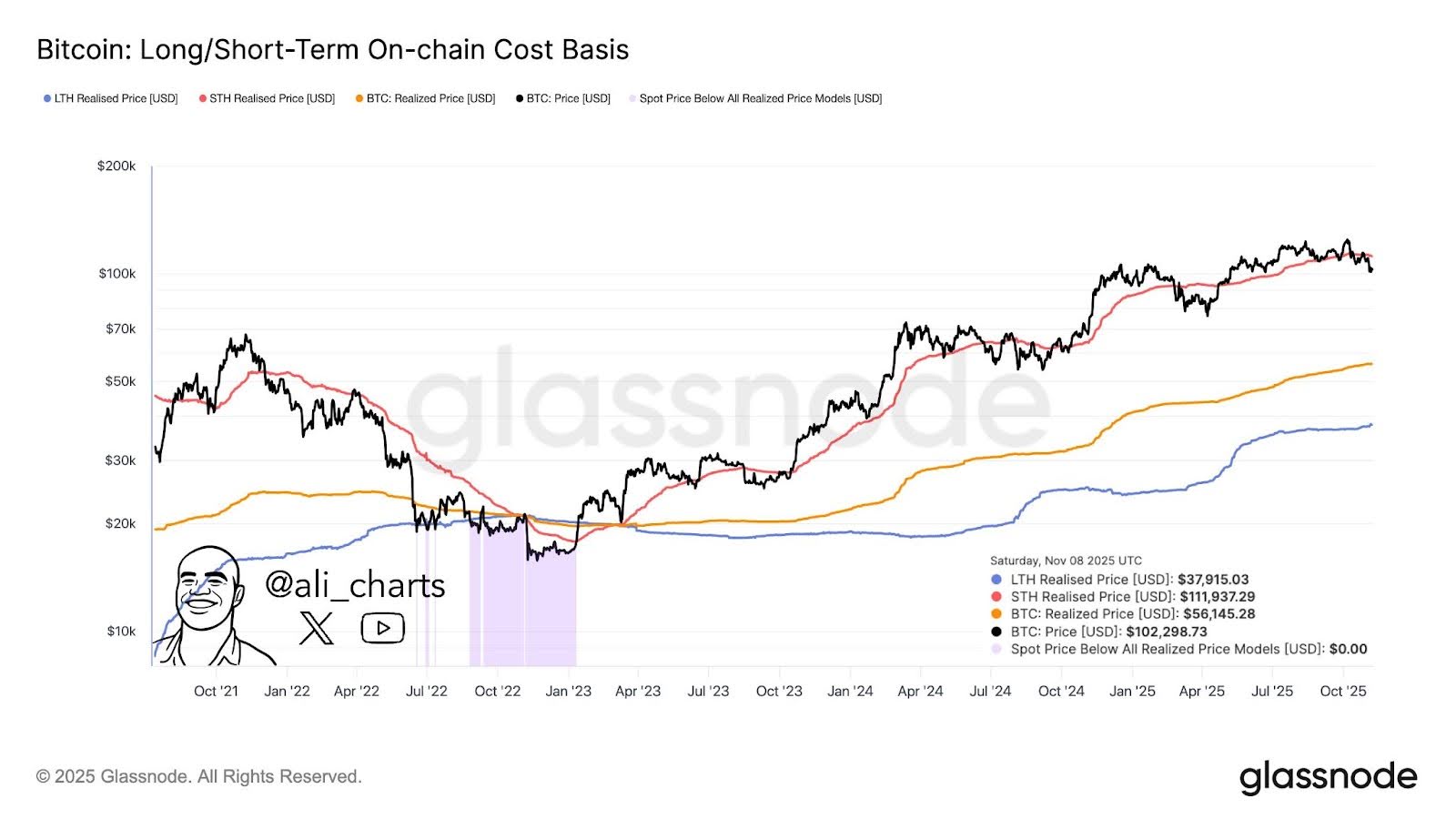

Bitcoin is still trading below the short-term holder realized price at around $112,000. That level often reflects how newer investors feel, and staying under it suggests confidence remains soft.

The chart shows spot prices near $102,000. The broader realized price is close to $56,000, and the long-term holder realized price sits near $38,000.

When BTC stays below the short-term cost basis, it has sometimes slipped toward deeper value areas in the past.

The chart indicates a slowing of short-term momentum after a strong run through 2024–25. Long-term holders are still well in profit, but repeated failure to break above $112,000 keeps pressure on the market.

If sellers take control, the next major support sits near $56,000, with $38,000 as a deeper safety net.

Bitcoin is again hovering near $100,000, a level that has served as a solid psychological floor for months. The analyst’s chart shows BTC holding this area while moving within a long-term rising structure.

Price has bounced several times from the trendline that began forming in mid-2024, keeping the broader uptrend intact.

Earlier touchpoints on this line led to strong rallies of about 105% and 68% showing that buyers have consistently defended this zone.

Nevertheless, the market now faces a crucial moment. If BTC can hold above $100,000, it could attempt another run higher.

The chart leaves room for $126,000, which would fit with the pattern of higher lows and likely support a more confident tone among traders. If that break fails, downside risks remain.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The post Rich Dad, Poor Dad Claims Bitcoin Price Still Going to $250K: Is Bitcoin Price Prediction Still Bullish? appeared first on 99Bitcoins.