Zero fee crypto exchanges are changing how smart traders maximize profits by eliminating trading costs. In a market where every percentage point counts, these platforms provide a competitive edge with each trade. However, not every “zero fee” exchange keeps its promise. Some hide costs behind spreads, limit features, or weak security. That’s why finding a truly dependable platform is more important than ever.

In this guide, we will look at the best platforms that offer zero fee crypto trading. We will discuss the coins they support, their security measures, and user experience. If you want to trade smarter, cut costs, and keep more of your earnings in 2025, let’s get started.

Top Lowest Fee Crypto Exchange: Overview Comparison

| Exchange | Maker/Taker Fees | Supported Coins | Unique Selling Point | Exchange Token Discount |

| Binance | 0.10% / 0.10% (Spot) | 350+ | Largest exchange by trading volume with a robust ecosystem. | 25% discount with BNB token. |

| MEXC | 0.00% / 0.10% (Spot) | 1,700+ | Extensive altcoin selection and frequent new listings. | Fee discounts with MX Tokens. |

| KuCoin | 0.10% / 0.10% (Spot) | 800+ | Focus on smaller-cap altcoins and crypto gems. | Up to 20% discount with KCS token. |

| OKX | 0.08% / 0.10% (Spot) | 350+ | Integrated Web3 wallet and DeFi focus. | Discounts with OKB token. |

| HTX (Huobi) | 0.20% / 0.20% (Spot) | 600+ | Long-standing exchange with global reach. | Discounts with Huobi Token (HT). |

| Phemex | 0.10% / 0.10% (Spot) | 350+ | Premium membership for zero fee spot trading. | Discounts with Phemex Token (PT). |

| Coinbase One | $0 Maker/Taker fees (Subscription) | 200+ | Zero fees with subscription, priority support. | N/A (Subscription-based). |

| Bybit | 0.10% / 0.10% (Spot) | 1,000+ | Advanced trading tools, copy trading, and the derivatives market. | 25% discount with MNT token. |

| Strike | Varies by spread | BTC, ETH, USDT | Simple interface for Bitcoin and global payments. | N/A |

| River | 0% (Recurring Buys) | Bitcoin only | Zero fee dollar-cost averaging (DCA) for Bitcoin. | N/A |

10 Best Zero Fee Crypto Exchanges in 2025

Let’s take a closer look at the best zero fee crypto exchanges that are changing trading in 2025. Choosing a platform with no trading fees can really boost your profits while offering features that meet your trading goals. Here are the top exchanges leading the way.

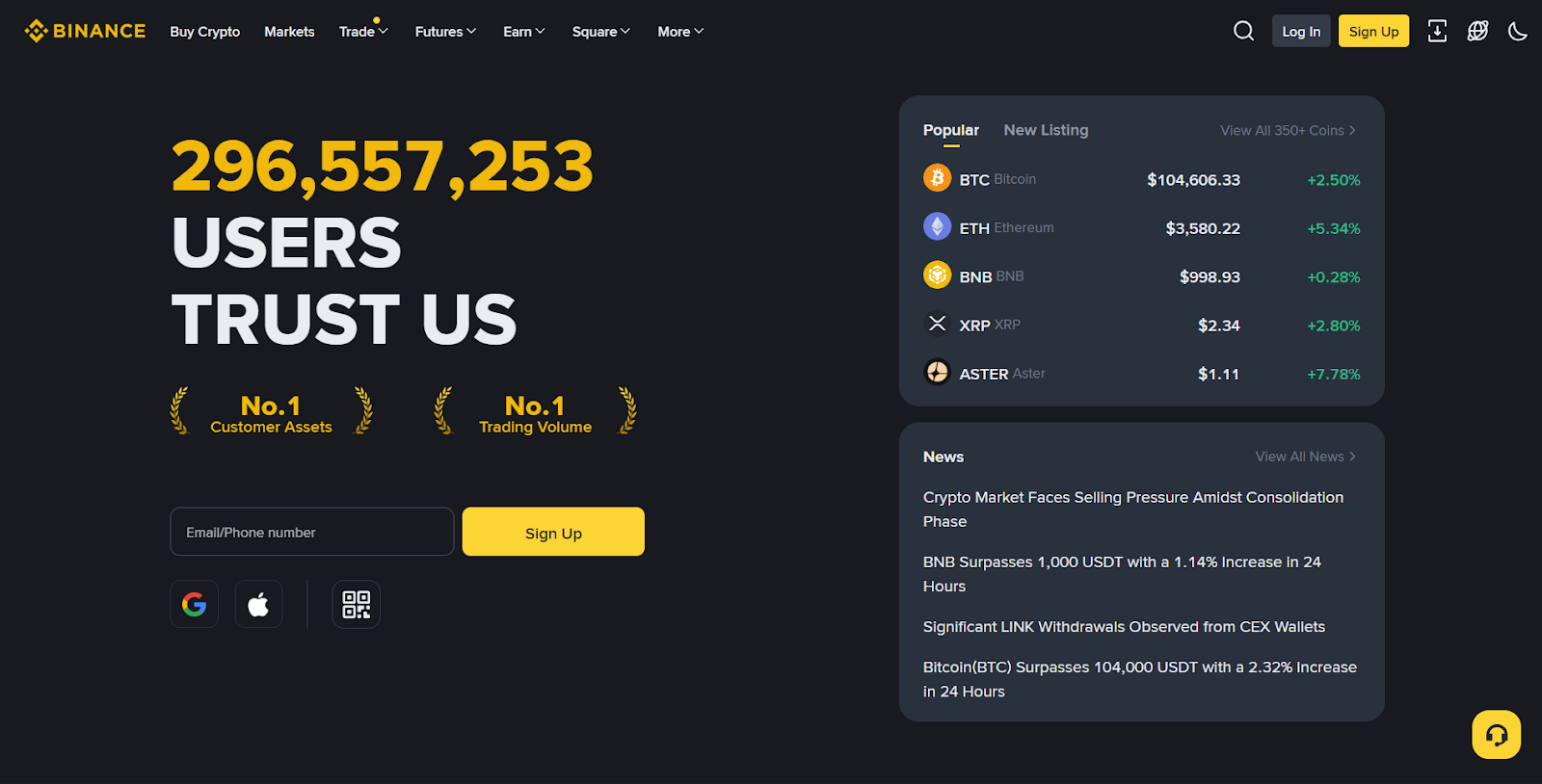

1. Binance

Established by Changpeng Zhao (CZ) in 2017, Binance has become the largest crypto platform in the world based on trading volume. Headquartered in the Cayman Islands, Binance offers a comprehensive ecosystem that includes spot trading, futures, staking, and a wide range of altcoins.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | 0.10% | 0.10% | Low fees for trading cryptocurrencies, with discounts available using BNB. |

| Deposit Fee | Free | Free | No fees for adding funds to your account. |

| Withdrawal Fee | N/A | N/A | Fees vary by cryptocurrency and are based on network costs. |

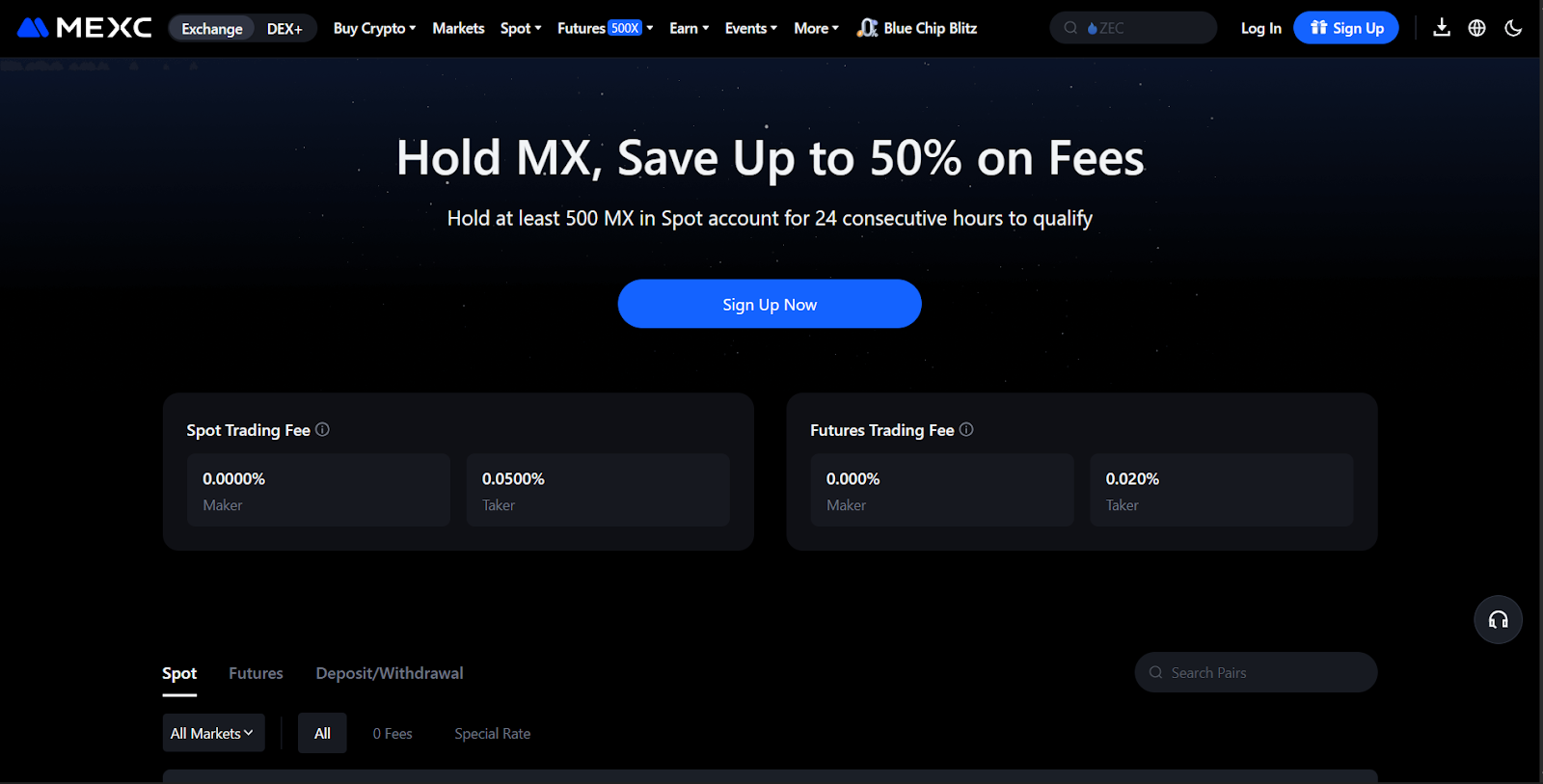

2. MEXC

MEXC is a well-known cryptocurrency exchange, particularly popular among traders for its competitive fees and extensive range of supported cryptocurrencies. Established in 2018 and headquartered in Singapore, MEXC has built a reputation as a user-friendly platform catering to both beginners and experienced traders.

Initially focused on spot trading, MEXC has expanded its offerings to include futures trading, staking, and other advanced trading tools. The platform is also recognized for its zero maker fees and low taker fees, making it a cost-effective choice for frequent traders.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | 0.00% | 0.05% | Zero maker fees and low taker fees for trading cryptocurrencies. |

| Deposit Fee | Free | Free | No fees for adding funds to your account. |

| Withdrawal Fee | N/A | N/A | Fees vary by cryptocurrency and are based on network costs. |

3. KuCoin

KuCoin has been helping cryptocurrency traders since 2017, offering a wide range of digital assets and advanced trading features. Based in Seychelles, KuCoin provides everything you need, from spot trading and futures to staking and lending. Whether you’re new to trading or a pro, you’ll find tools and options designed to meet your needs.

You’ll appreciate KuCoin’s competitive fee structure, which makes it one of the cheapest crypto trading platforms available. By holding their native token, KCS, you can unlock even lower fees, making KuCoin a top choice for those seeking a crypto exchange with the lowest fees. The platform also offers a mobile app, allowing you to trade on the go with ease. With strong security measures and diverse trading options, KuCoin ensures a seamless and reliable experience.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Trading Fee | Floating fee rate: 0.020% | Floating fee rate: 0.060% | Applicable to all trading activities. |

| Settlement Fee | 0.025% | 0.025% | Generated when the contract is settled. |

| Deposit Fee | Free | Free | No fees for depositing funds into your account. |

| Withdrawal Fee | Varies by cryptocurrency | Varies by cryptocurrency | Fees depend on the specific cryptocurrency being withdrawn. |

4. OKX

OKX is a versatile platform designed for traders who value advanced tools and a seamless trading experience. Unlike many exchanges, OKX offers a comprehensive ecosystem that includes spot trading, futures, staking, and even DeFi services. Its focus on innovation makes it a go-to choice for traders looking to explore beyond basic trading.

What sets OKX apart is its tiered fee structure, which rewards high-volume traders and users holding OKB, the platform’s native token. This makes it particularly appealing if you’re looking to minimize costs while maximizing trading opportunities. The platform also boasts a highly intuitive mobile app, ensuring you can manage your portfolio anytime, anywhere.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Spot Trading Fee | 0.08% | 0.10% | Standard fees for spot trading. Discounts available with OKB. |

| Futures Trading Fee | 0.02% | 0.05% | Designed for futures traders seeking low costs. |

| Deposit Fee | Free | Free | No fees for depositing funds into your account. |

| Withdrawal Fee | Varies by cryptocurrency | Varies by cryptocurrency | Fees depend on the specific cryptocurrency being withdrawn. |

5. HTX

HTX, formerly known as Huobi, is a globally recognized cryptocurrency exchange headquartered in Seychelles. Originally founded in China, the platform has expanded its operations to include offices in Hong Kong, South Korea, and Japan. HTX is celebrated for its user-friendly interface, diverse cryptocurrency offerings, and advanced trading tools, making it a popular choice for both beginners and experienced traders.

One of HTX’s standout features is its focus on security and innovation. The platform employs robust security measures, including cold storage for funds and multi-factor authentication, to ensure user assets are protected. Additionally, HTX offers a mobile app for seamless trading on the go, catering to the needs of modern traders.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | 0.20% | 0.20% | Standard fees for spot trading. Discounts available for VIP users. |

| Deposit Fee | Free | Free | HTX does not charge for deposits, ensuring easy account funding. |

| Withdrawal Fee | Depends on the cryptocurrency | Depends on the cryptocurrency | Fees are determined by the specific asset and its network conditions. For example, Bitcoin withdrawals may have a fixed fee, while others vary based on network traffic. |

6. Phemex

Phemex is one of the best no fee crypto exchanges, making it a top choice for traders who want to save on costs. It offers zero trading fees for spot trading, which means you can buy and sell cryptocurrencies without paying extra. This feature is especially appealing if you’re a frequent trader looking for the crypto trading platform with lowest fees.

Phemex also provides educational resources through its Phemex Academy, helping you learn more about trading strategies. The platform is designed to be user-friendly, whether you’re new to crypto or an experienced trader. Security is a priority, with advanced measures in place to protect your funds.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | 0% | 0% | Zero trading fees for spot trading. |

| Deposit Fee | Free | Free | No fees for adding funds to your account. |

| Withdrawal Fee | Depends on the cryptocurrency | Depends on the cryptocurrency | Fees vary based on the coin and network conditions. |

7. Coinbase One

Coinbase One, introduced in 2022, is a subscription service designed for active traders. It offers zero trading fees on up to $10,000 worth of trades per month. Available in the US, UK, and select European countries, Coinbase One also provides priority customer support, higher interest rates on eligible balances, and rebates on some spot trading fees.

This service is ideal for high-volume traders who want to save on fees while enjoying premium features like insurance coverage for digital assets.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | 0% | 0% | Zero fees for eligible trades under the subscription. |

| Deposit Fee | Free | Free | No fees for deposits, making it easy to fund your account. |

| Withdrawal Fee | Varies by method | Varies by method | Fees depend on the withdrawal method, such as bank transfer or crypto. |

8. Bybit

Bybit, founded in 2018, is a global crypto exchange that supports over 100 cryptocurrencies. It’s particularly popular for derivatives trading, offering perpetual contracts and futures with competitive fees. Bybit operates in over 150 countries, with restrictions in only a few regions, making it accessible to a broad range of traders.

The platform also offers spot trading with low fees, a copy trading feature to follow top traders, and an intuitive mobile app for trading on the go. Bybit’s robust security measures include cold storage and two-factor authentication to protect your funds.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | 0.01% | 0.06% | Low fees for derivatives trading. |

| Deposit Fee | Free | Free | No fees for deposits, making it easy to start trading. |

| Withdrawal Fee | Varies by cryptocurrency | Varies by cryptocurrency | Fees depend on the coin and network. |

9. Strike

Strike, launched in 2020, is a Bitcoin payment app that uses the Lightning Network for instant and low-cost transactions. It’s available in the US, El Salvador, and select European countries, making it a practical choice for international payments.

Strike allows you to link your bank account, add funds, and convert them to Bitcoin easily. The app is designed to be simple and accessible, even for beginners. It’s an excellent option if you’re looking for a no fee crypto exchange for everyday payments.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | Free | Free | No fees for sending or receiving Bitcoin. |

| Deposit Fee | Free | Free | No fees for adding funds to your account. |

| Withdrawal Fee | Free | Free | No fees for withdrawing Bitcoin to your wallet. |

10. River

River, established in 2019, is a Bitcoin-only platform that focuses on long-term investment. It’s available in the US and offers services like secure storage, Bitcoin mining, and a straightforward way to buy and sell Bitcoin. River charges a flat 0.20% fee for transactions, making it a competitive option for those looking for the cheapest crypto exchange fees. Security is a top priority, with multi-signature wallets and cold storage protecting your Bitcoin.

Fee Structure

| Fee Type | Maker Fee | Taker Fee | Description |

| Transaction Fee | 0.20% | 0.20% | Standard fees for buying and selling Bitcoin. |

| Deposit Fee | Free | Free | No fees for deposits, making it easy to fund your account. |

| Withdrawal Fee | Fixed fee | Fixed fee | A flat fee applies to Bitcoin withdrawals. |

What’s the Difference Between Maker and Taker Fees?

Maker and taker fees are charges applied to different types of trades on a cryptocurrency exchange. A maker fee is charged when you place an order that doesn’t get filled immediately, such as a limit order. This type of order adds liquidity to the market because it creates an opportunity for other traders to match your order. For example, if you set a limit order to buy Bitcoin at $30,000 and the current price is $30,500, your order will sit in the order book until the price drops to your specified level.

On the other hand, a taker fee applies when you place an order that is instantly matched with an existing one, like a market order. In this case, you are removing liquidity from the market by completing a trade that was already available. Taker fees are often higher than maker fees because exchanges want to encourage traders to add liquidity. By understanding these fees, you can choose the right type of order to save on trading costs and optimize your strategy.

How to Reduce Crypto Exchange Fees

- Choose crypto exchange with lowest fees: Consider platforms offering zero trading fees on spot trading or those charging very competitive fees, like Phemex and Coinbase One.

- Use limit orders instead of market orders: Limit orders typically have lower maker fees compared to the taker fees charged for market orders.

- Avail fee discounts: Many exchanges give a discount if you pay for fees in their native tokens, such as Binance Coin on Binance.

- Increase your trading volume: Some of the exchanges have tiered fee structures that reduce the fees charged to high-volume traders.

- Look for subscription plans: Services like Coinbase One offer zero fees on a set number of trades per month for a flat subscription fee.

- Withdraw in cheaper cryptocurrencies: In cases of withdrawal, use the coins with the cheapest network fees, such as Litecoin or Polygon, instead of Bitcoin or Ethereum.

- Time your withdrawals: Withdraw during periods of low network congestion to avoid higher dynamic fees.

- Consolidate your trades: Instead of making multiple small trades, combine them into fewer, larger transactions to minimize fees.

Are Crypto Trading Fees Tax-deductible?

Crypto trading fees can sometimes be tax-deductible, but that greatly depends on your country’s tax policies and how your trading activities are classified. In many cases, professional traders operating their businesses may be able to offset trading fees as a business expense. These would be fees incurred in the process of earning taxable income to reduce one’s overall tax liability. Individual investors might not have that flexibility, as personal investment expenses are treated differently under tax laws in general.

Even though trading fees might not be directly deductible, they could still impact your taxable gains. Most tax authorities allow fees to be included in the cost basis of your cryptocurrency. That means you can subtract, for example, fees that have been paid to buy or sell crypto from your profits, thereby reducing your capital gains. In order to take advantage of such provisions, it is crucial to keep a record of all transactions and their respective fees. Consulting a tax professional will make it clearer how these rules apply to your specific situation and help you comply with local tax laws.

What Other Fees Do Crypto Exchanges Charge?

Even on zero fee platforms, traders can still face extra costs that impact their profits. Here are the most common types:

- Margin Fees. For leveraged trading, exchanges charge margin fees, which include interest on borrowed funds. These fees vary depending on the platform and leverage ratio.

- Funding Fees. In perpetual futures trading, funding fees are exchanged between long and short traders to maintain price alignment with the spot market. Funding fees are dynamic and depend on market conditions.

- Fiat Conversion Fees: These fees apply when converting fiat currency (e.g., USD, EUR) into cryptocurrency. They are typically higher than crypto-to-crypto conversion fees.

- Withdrawal Fees: Most exchanges charge fees for withdrawing cryptocurrencies, which vary depending on the asset and network conditions. Some platforms, like Phemex, offer zero withdrawal fees for certain users.

- Deposit Fees: While many exchanges provide free deposits, some may charge fees for specific deposit methods, such as wire transfers or credit card payments.

- Subscription Fees: Platforms like Coinbase One offer subscription plans for zero trading fees on a set number of trades per month, but these come with a monthly cost.

- Network Fees: Decentralized exchanges (DEXs) require users to pay blockchain gas fees, which fluctuate based on network congestion.

Conclusion

In 2025, the top 10 crypto exchanges will offer a diverse range of features, catering to traders with varying needs and preferences. From Binance’s extensive cryptocurrency selection and low fees to Coinbase One’s subscription-based zero fee trading, each platform brings unique advantages to the table.

Exchanges like Kraken Pro and Bitstamp stand out for their security and trustworthiness, while others like Bybit and Phemex excel in advanced trading tools and derivatives. For Bitcoin-focused users, Strike and River provide zero fee options tailored to simplicity and accessibility.

FAQs

Which crypto exchange has the lowest fees?

Binance is widely regarded as one of the exchanges with the lowest fees, offering a flat 0.10% maker and taker fee for spot trading. Additionally, users can reduce fees by 25% when paying with Binance Coin (BNB).

Which is the cheapest crypto trading platform compared to Coinbase?

Platforms like Binance, Kraken Pro, and Bitstamp are often cheaper than Coinbase in terms of trading fees. For example, Binance charges 0.10% per trade, while Kraken Pro offers fees as low as 0.16% for makers and 0.26% for takers.

Are no fee crypto exchanges safe to use?

No fee exchanges like Strike and River are generally safe, provided they have strong security measures in place, such as cold storage, two-factor authentication, and regulatory compliance.

Are decentralized exchange fees lower?

Decentralized exchanges (DEXs) often have lower trading fees, typically ranging from 0.1% to 0.5%. However, users must also account for blockchain gas fees, which can vary depending on network congestion.

What’s the difference between fiat-to-crypto and crypto-to-crypto fees?

Fiat-to-crypto fees are typically higher because they involve converting traditional currency (like USD or EUR) into cryptocurrency. These fees often include deposit charges, conversion fees, and trading fees.