Bitcoin price jumped above $95,000 on Wednesday after fresh US inflation data came in lower than expected. BTC climbed over 4% in 24 hours, while Ethereum, Solana, and Cardano posted gains near 8%. The move fits a familiar pattern: when inflation cools and interest rate pressure eases, investors rush back into risk assets like crypto.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

Why Did Bitcoin Suddenly Jump Above $95K?

Inflation is the speed at which prices rise. When it slows, borrowing money gets cheaper, and investors feel more comfortable taking risks. That is exactly what happened after the latest US inflation report.

Bond yields fell, the dollar weakened, and cash started looking for a new home. Bitcoin often benefits in this setup because many investors see it as a hedge against central bank uncertainty. Softer inflation and global tensions have repeatedly pushed demand toward Bitcoin as a non-government asset.

Core CPI at 2.6% marks the lowest US inflation reading since March 2021

Trump pressures Fed Chair Jerome Powell to cut rates, markets bets no until June

December report

eats expectations as headline inflation holds steady at 2.7%

95% odds the Fed holds rates this month pic.twitter.com/IbXhwF1huk

— Boi Agent One (@boiagentone) January 13, 2026

Altcoins followed fast. Ether pushed toward $3,300, while Solana and Cardano jumped close to 9%. This signals renewed appetite for risk, not just a one-coin spike.

What Does This Rally Mean for New Crypto Investors?

Basically, momentum is back, but so is danger. When prices move this fast, traders using borrowed money get wiped out first.

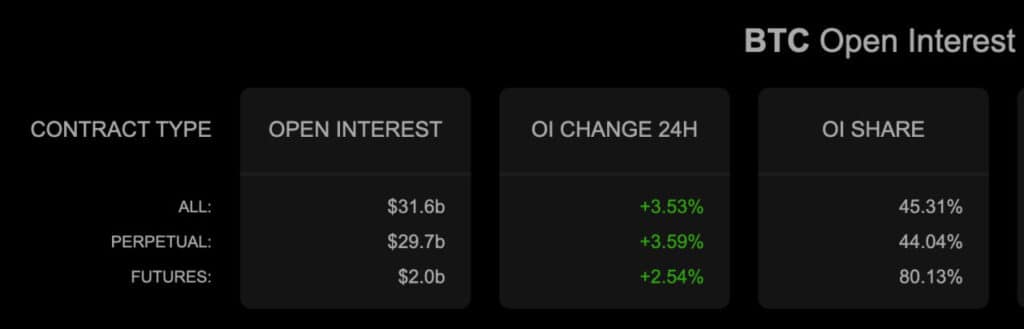

(Source: Bitcoin Open Interest / Coinalyze)

Over $688 million in crypto futures positions vanished in one day as prices surged. About $603 million came from traders betting against the market. Futures are contracts that let traders use leverage, meaning they borrow money to amplify gains. When price moves the wrong way, losses hit hard and fast.

For beginners, this matters because sharp rallies often attract emotional buying. Chasing green candles usually ends badly. If you are new, focus on spot buying only. That means buying real coins without leverage.

DISCOVER: Top 20 Crypto to Buy in 2026

Rising Volatility Is the Hidden Cost of Fast Gains

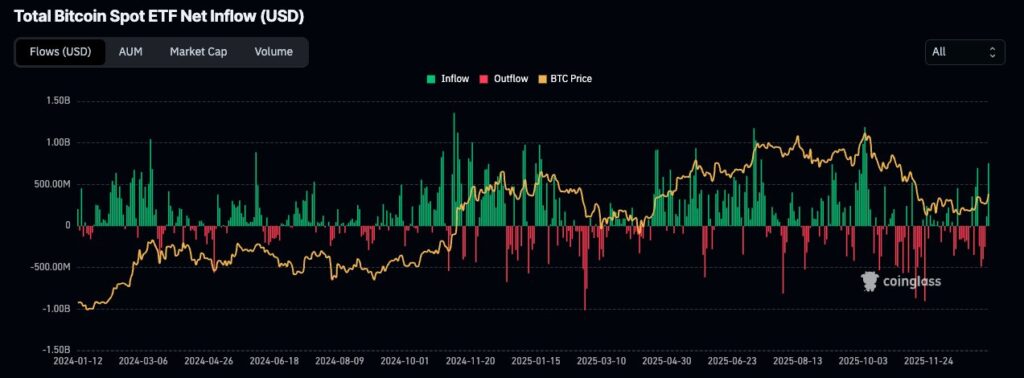

(Source: Bitcoin ETFs had $753.8M in net inflows yesterday, the most since 10 October / Coinglass)

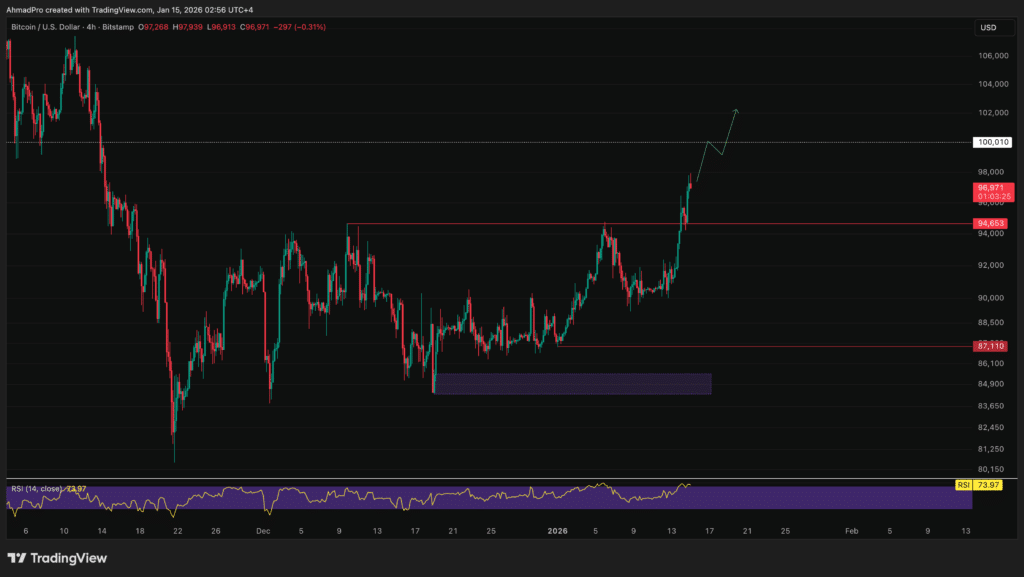

Bitcoin is now approaching price levels that triggered heavy selling earlier in January. At the same time, derivatives data shows leverage rebuilding quickly. This combo usually leads to wild price swings.

Think of leverage like stacking dominoes. It looks stable until one small push knocks everything over. If Bitcoin stalls near $95K, liquidations can flip direction just as fast.

Traditional markets confirm the risk-on mood. Asian stocks hit record highs, and gold hovered near its peak. That alignment matters because Bitcoin now trades more like a macro asset. Bitcoin’s correlation with traditional markets continues to rise, particularly during macroeconomic-driven moves.

(Source: BTCUSD / TradingView)

Safety Check: How to Approach This Rally Without Getting Burned

If this rally has your attention, you may slow down. Fast moves reward patience, not impulse.

If considering buying near market highs, keep your position sizes small, avoid using leverage unless you are highly experienced, and make sure you have a clear plan in place before entering a trade, including where you will exit and how much risk you are willing to take.

Ethereum’s surge toward $3,300 shows how quickly sentiment can flip. We covered this setup in our breakdown of the recent Ethereum price rally and why resistance matters.

If inflation stays calm and rate cuts remain on track, crypto momentum can hold. Just remember: when risk appetite snaps back, volatility always follows.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Bitcoin Breaks $95K as Inflation Data Sparks Risk-On Rally appeared first on 99Bitcoins.