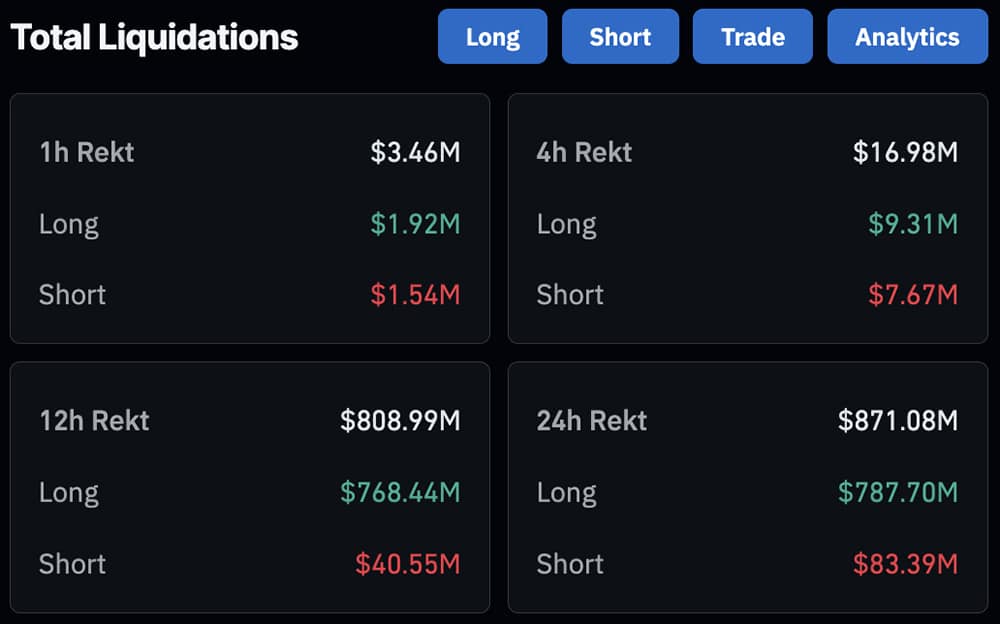

Why is crypto down today? BTC USD drifted to the $92,000 area, and ETH USD got hit harder, now under $3,200. The mood and sentiment changed fast as liquidations broke this year’s record, screens turned red, and we got caught off guard. Close to $800 million in leveraged long bets disappeared as pressure builds.

(source – Coinglass)

Why is crypto down today also connects to where money moved. While BTC USD and ETH USD softened, capital is still rotating into metals. Gold and silver surged to new highs above, with Gold records $4,660 an ounce, pulling funds away from other assets as World War 3 talk intensifies. Today, the crypto market has lost by more than $100 billion, with total market cap sliding to $3.217 trillion, or a big 2.8% drop in 24 hours.

(source – CoinGecko)

Really, Why Is Crypto Down Today?

What is it then? Why is crypto down today? Politics and pricing risk might play a big part. Donald Trump’s announcement of 10% tariffs on eight European countries tied to Greenland reignited trade war anxiety. The market priced in possible EU retaliation worth up to $100 billion. The fear alone was enough to pressure BTC USD and ETH USD, especially with leverage already elevated across futures markets.

BREAKING: France’s President Macron calls for the EU to activate its "most potent trade weapon" against the US after President Trump's tariff threat over Greenland.

Macron is now calling for the use of the EU's "anti-coercion instrument."

If used against the US, it would… pic.twitter.com/E47Bpe03lK

— The Kobeissi Letter (@KobeissiLetter) January 18, 2026

Equities also weakened alongside crypto, though the drops are incomparable. The S&P 500 slipped by about 1% with European stocks following the free fall. BTC and ETH tracked the same direction against USD, with thinner liquidity and aggressive derivatives positioning. Selling pressure keeps building as stop losses are triggered, reminding us of the October 10 last year leverage hunting, when tariffs also triggered mass liquidations, even bigger than today.

Geopolitical factors are helping the price action, too. China’s chip export restriction is a global uncertainty, which pushes money toward defensive assets. On-chain data from Santiment displays a rising negative sentiment, with whale wallets trimming their crypto exposure. Those above and holiday conditions around Martin Luther King Jr. Day worsened volatility and brought panic selling.

#BREAKING China blocks Nvidia H200 AI chips that US government cleared for export – The Guardian pic.twitter.com/ZPoJK0jFK8

— War Intel (@warintel4u) January 18, 2026

DISCOVER: 10+ Next Crypto to 100X In 2026

Where BTC USD and ETH USD Go From Here

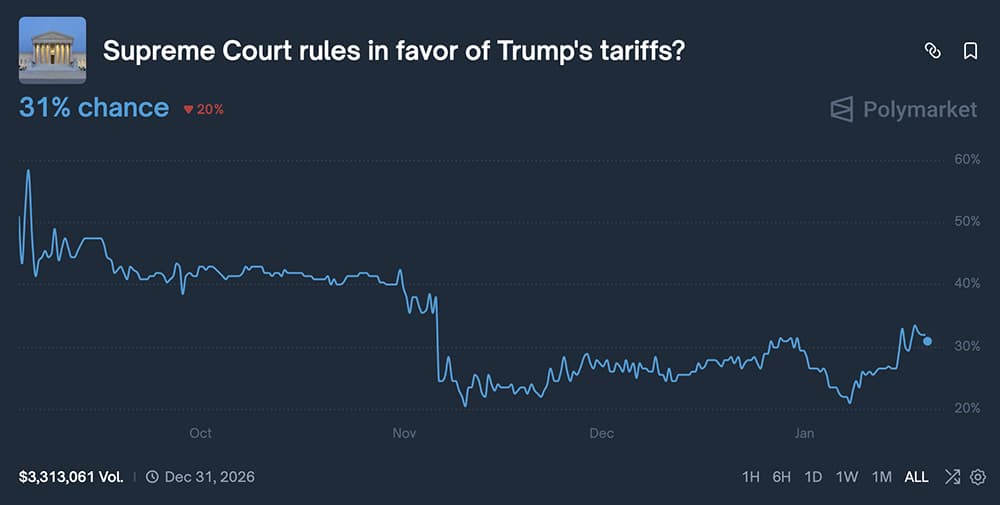

What are our short-term expectations? Polymarket now has a 70% chance that the US Supreme Court rules Trump’s tariffs illegal. This outcome would likely bring fast relief across risk assets, including ETH and especially BTC against USD. A ruling the other way keeps pressure alive and delays any meaningful recovery.

(source – Polymarket)

From a chart perspective, BTC USD sits at a line we should respect. A clean break below $92,000 opens room toward the mid-$80,000s, while stability above that zone keeps late January targets of $98,000 in play. ETH USD continues to show relative strength, with $3,500 to $3,7000 levels expected, although it needs consistent ETF inflows.

Why is crypto down? Policy headlines, liquidity gaps, and leveraged positioning, especially leverage positions. Maybe spot the market, gamble on a prediction market, cause leverages kill the vibes.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Steak ’n Shake Buys $10M in Bitcoin After Testing Lightning Payments

Will 2026 be the year of the “Bitcoin Standard”? Looks like so. Institutional adoption started when Michael Saylor and MicroStrategy started adding Bitcoin to its balance sheet. After four years of consistency, the US tech firm is now the largest holder of BTC among public companies. MicroStrategy holds more Bitcoin than the US, at least from public data, and even China.

Given the benefits the MicroStrategy stock got after Saylor chose Bitcoin, many public companies are lining up, looking to copy their strategy. Whether they will succeed or not largely depends on how BTC and the next 100X crypto firms perform. At the moment, though, the Bitcoin price is steady, and increasingly, if political fires diminish, bulls are looking for a solid close above $100,000.

Among the firms adopting Bitcoin is Steak ’n Shake. On January 17, they just bought $10M worth of Bitcoin for its corporate treasury, months after rolling out Lightning Network payments across US stores.

Read the full story here.

Saylor Hints at Fresh Bitcoin Buy As US Tariffs Spook the Market

Michael Saylor reportedly hinted that Strategy may buy even more Bitcoin, just days after spending $1.25Bn on a fresh batch of BTC. The entire crypto market plummeted overnight, falling -2.8% to $3.2 trillion, with Bitcoin dropping -2.5%, to $92,500 as the news spread, holding firm rather than selling off. This comes as institutions, from ETFs to public companies, continue to stack Bitcoin early in 2026.

Crypto took a nosedive over the past 24 hours amid rising tensions between the US and Europe over Greenland. President Trump has imposed huge tariffs on any European nation standing in the way of the United States claiming Greenland.

In a post on his Truth social media platform, Trump listed the UK, the Netherlands, Finland, Norway, Denmark, France, and Germany as countries set to be hit with 10% tariffs beginning February 1, 2026, rising to 25% on June 1, 2026.

JUST IN: Trump says he will impose a 10% tariff on on goods sent to the U.S. from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland on Feb. 1, rising to 25% on June 1, “until such time as a Deal is reached for the Complete and Total purchase of… pic.twitter.com/iV1uymwgow

— Republicans against Trump (@RpsAgainstTrump) January 17, 2026

Read our full coverage here.

Binance Reopens Instant Bank Transfers for Australia After 2 Years

Binance Australia has reopened direct bank transfers for Australian users, allowing verified customers to deposit and withdraw Australian dollars (AUD) via PayID and standard bank transfers after more than two years without these services. This change reinstates real-time fund movement between local bank accounts and the Binance platform, removing a major hurdle that Australian traders faced since mid-2023.

PayID is a widely used domestic payment method in Australia that lets users send money using a phone number, email address, or ABN instead of long bank account details.

Now, Australian customers can move funds into and out of Binance more quickly and at a lower cost than before.

AUD deposits & withdrawals are back on Binance AU 🇦🇺

PayID or BSB. Fast. Simple. Secure.

Deposit AUD & start trading 👉 https://t.co/jLZ5yeJr55 pic.twitter.com/46xO7Mdfjn

— Binance Australia (@Binance_AUS) January 19, 2026

Read the full story here.

Bitcoin BTC USD Price Slides Below $92K as Tariff Fears Spook Global Markets

Under Donald Trump, you can’t mention the president without tariffs. Tariffs have become a defining aspect of President Trump, and the global economy often reacts with caution. Not only do asset prices fall, but risky ones are often the most affected.

In 2025, Bitcoin and some of the best cryptos to buy could have flown to record highs if not for tariffs. Multiple tariff threats to China and European countries, some allies to the US, stalled growth. And in 2026, we are back again to fund managers possibly “managing risks” attached to tariffs.

President Trump announces tariffs on 8 European nations in a move to reach a deal to acquire Greenland. pic.twitter.com/Bzr8uIZjqF

— America (@america) January 17, 2026

On January 17, Trump proposed new tariffs on eight European countries, including the UK, Germany, and Germany. As expected, risk assets, mostly the next cryptos to explode, reversed gains, sliding. Ethereum fell towards $3,200 while Bitcoin crashed below $95,000 towards $92,000.

Read the full story here.

The post Crypto Market News Today, January 19: Why is Crypto Down Today? BTC USD Falls to $92,000 Level, ETH Under $3,200 appeared first on 99Bitcoins.