- Ripple launches Ripple Treasury via GTreasury, unifying cash and crypto with reconciliation, forecasting, and liquidity tools.

- Platform targets 24/7 settlements, lower FX costs, and no pre-funding; Ripple says XRP stays central.

Ripple has launched Ripple Treasury, a unified enterprise platform that combines traditional cash management with digital asset rails. The move adds a new product line to Ripple’s broader push into custody, stablecoins, and institutional services.

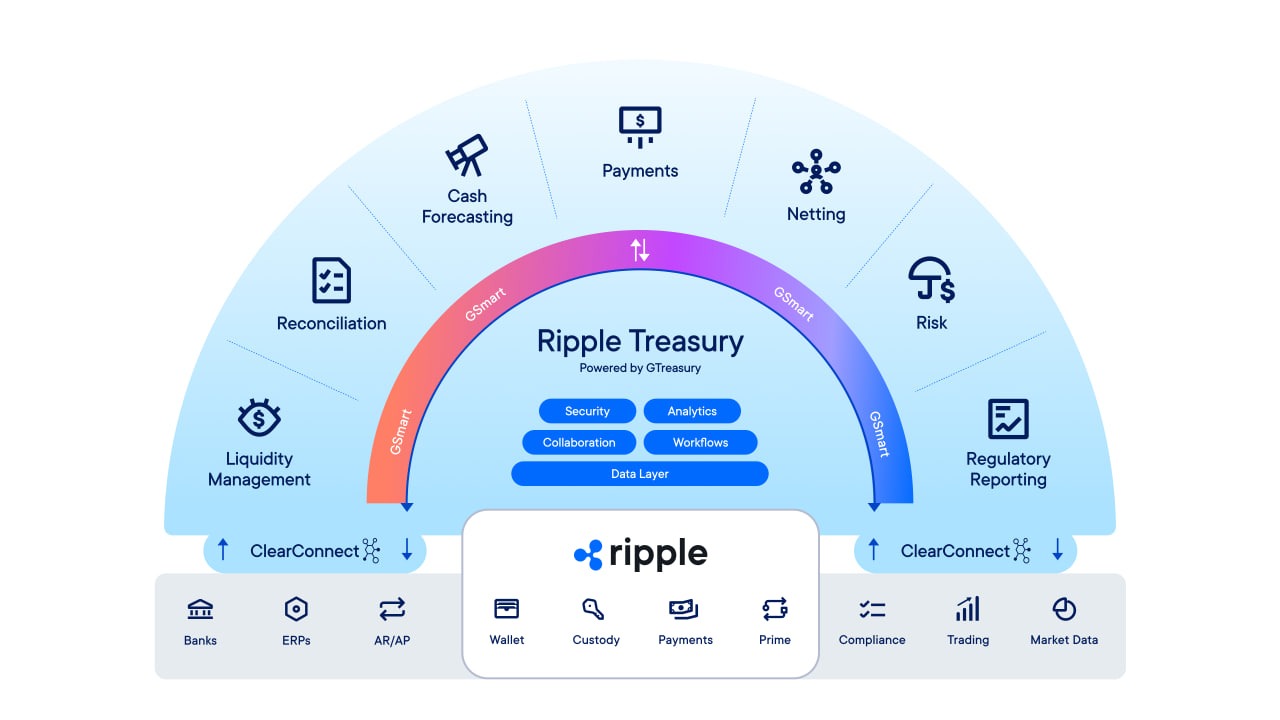

Ripple Treasury is powered by GTreasury, a treasury management firm owned by Ripple. The platform is designed to support finance teams that handle liquidity management, reconciliation, forecasting, and payment across various systems. It aims to give a single view across fiat positions and digital assets, while supporting always-on settlement and treasury workflows.

Introducing @Ripple Treasury 🚀

→ Unified visibility across traditional cash and digital assets

→ 24/7 yield optimization putting every dollar to work

→ Instant cross-border settlements reducing FX costs

→ Eliminate pre-funding requirements and unlock trapped working capital… https://t.co/C6uJ5ijh2J— Reece Merrick (@reece_merrick) January 27, 2026

In posts on X, Ripple executive Reece Merrick introduced Ripple Treasury and listed core functions. These include unified visibility across traditional cash and digital assets, 24/7 yield optimization, and instant cross-border settlements to reduce foreign exchange costs.

Ripple Connects Treasury Processes with Digital Asset Infrastructure

As GTreasury lays out, the platform links long-term enterprise treasury assets with digital asset infrastructure. It comes equipped with AI-powered forecasting and analytics, liquidity management, real-time reconciliation, and risk controls.

“With Ripple’s backing, we reinvest 100% of earnings into platform innovation with zero debt constraining our roadmap,” GTreasury wrote on X. The company has also doubled engineering capacity in the past 90 days and acquired Solvexia to strengthen reconciliation features. It has also added AI tools across cash forecasting, risk management, and analytics.

The new product is positioned for enterprises seeking faster settlement and simpler treasury operations, without splitting workflows across multiple vendors. According to GTreasury, the product can reduce FX costs and eliminate pre-funding, while supporting tokenized assets and programmable payments as corporate use expands.

The company plans a live session tomorrow to demonstrate Ripple Treasury capabilities. GTreasury said the event will cover production use cases in operation today and how digital asset infrastructure can integrate with existing treasury systems.

As we earlier reported, Ripple completed a $1 billion acquisition of GTreasury in late 2025. The acquisition resulted in Ripple increasing its presence in corporate finance businesses, providing treasury software and business processes to its stack.

In response to rising concerns, Ripple executives have also pointed out that XRP is still central to the strategy of the company. Merrick wrote that “XRP will continue to be at the heart” of Ripple’s vision. A further update is scheduled for mid-February, with an X Spaces session on Feb. 11 led by Ripple President Monica Long and moderated by Jacquelyn Melinek, CEO of Token Relations, focused on Ripple’s evolution and XRP’s role.

In the meantime, the XRP price has fairly recovered after breaching the resistance at $1.90. At press time, XRP was trading at $1.92, a 1.06% increase.