- Growing talk of spot XRP ETFs sparks expectations of fresh capital and price swing.

- Historical November performance creates cautious optimism while traders watch resistance around $2.75.

Ripple’s XRP has entered November with growing investor interest ahead of possible approval of the first US spot XRP ETFs. As reported by CNF, analyst Nate Geraci suggested that these funds may begin trading in mid-November 2025. Market watchers expect strong interest from large investors once these funds reach trading platforms.

Projections from several analysts indicate that more than $1 billion could enter the market during the early weeks of fund activity. A large inflow of capital has often driven sudden price acceleration in digital asset markets.

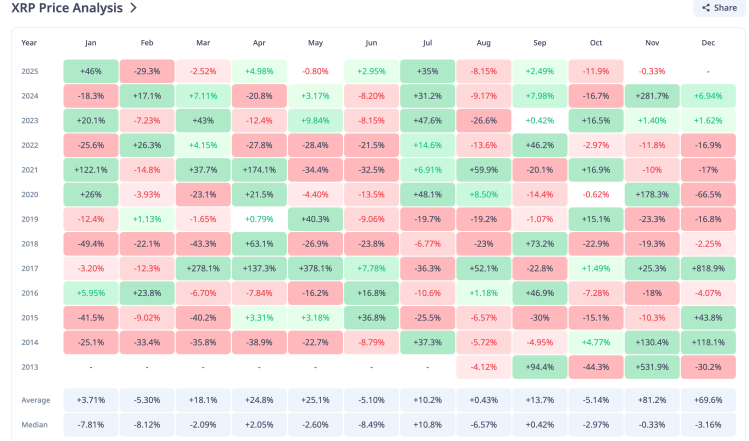

Additionally, historical data indicates that the token has often posted stronger gains in November. Market participants are anticipating a similar trend this time. However, the token ended October in the red, which has brought some caution among traders.

Historical Data Points to November Strength

Data from CryptoRank indicates that across the last 12 years, November has seen an equal number of green and red closes. Despite that balance, the months that closed green have produced massive gains.

During its first year, XRP recorded a 531.9% rise in November, setting a pattern of rapid growth that continued in later years. Even in weaker market phases, the token often recovered. December follows with an average return of 69.6%.

In 2024, the market saw a remarkable surge, with XRP closing November up 281.7% after suffering a 16.7% drop in October. That rebound triggered a 600% increase over the next few weeks, showing that a negative October does not always lead to a weak November.

XRP Open Interest Drop Mirrors 2024 Setup

Additionally, Coinglass data shows that open interest for the token peaked above $10 billion earlier in the year. Since that point, open interest has fallen by more than half and now stands below $5 billion. A low open interest can indicate reduced leveraged positioning, which sometimes allows fresh price building if buying returns.

A similar setup appeared in 2024 when open interest fell below $1 billion before momentum shifted upward through the middle of the month. If the same pattern repeats, the token could see a gradual climb before meeting resistance. Should buyers push through that resistance, some traders believe another triple-digit increase could follow, opening the path toward a new price record.

At the moment, XRP trades at $2.40. That is 37.44% below the June peak. Resistance appears close to $2.75. If strong buying enters the market, the price may test $3. If selling increases, a $2 return is possible, representing a drop of about 16% from the current price.